Denmark Dependent on Foreign Balancing Services

Several cases of negative spot prices in combination with Danish export of electricity in 2013 have been reported. These stories have fuelled the myth that wind power has caused enormous Danish losses in the international trade with electricity.

Other stories say that Danish wind energy covered 33% of the demand for electricity in 2013 with the usual high security of supply. These facts are supposed to prove that the wind integration problems have been solved successfully in Denmark for at least the 33% wind energy penetration.

Denmark is no longer self-sufficient

The wind energy production reached 54.8% of the electricity consumption in December 2013 and 61.8% in January 2014. The media have told of new records, but they ignore the dilemma that there is no room for both wind power and CHP in Denmark. The trend is that CHP plants are losing market shares and are being closed down. The side effect is that the dispatchable reserve capacity also disappears.

According to ENTSO-E's "Summer outlook report 2014 and winter review 2013/14" Denmark is expected to require imports to meet their electricity demand and reserve requirements throughout all weeks of summer 2014, even under normal conditions. The dispatchable Danish capacity in 2014 is 6,900 MW in Energinet.dk's data assumption. The expected peak load is 6,200 MW under normal conditions and 6,659 MW in extreme cases. The expected peak load in 2020 is 6,435 MW (and 6,911 MW in extreme cases). In 2020, the expected dispatchable capacity is about 5,800 MW.

The transmission system operator, Energinet.dk, is aware of the risk. Energinet.dk follows the preparation of capacity arrangements in the neighbouring countries and is prepared for purchasing the necessary capacity. Depending on the development in the international capacity markets the cost of this measure could be considerable.

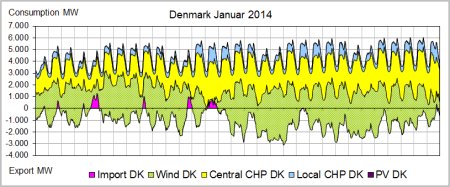

Electricity Surplus in January 2014

The chart shows the composition of electricity production with dispatchable generation in the top and wind power in the bottom. The PV contribution is insignificant in January.

The top profile follows the total electricity demand. Consequently, the surplus (export) is below the horizontal axis. It is obvious that the Danish demand cannot absorb the production from both CHP and wind.

In the first half of January there are several cases with very low output of wind power. Import has replaced the wind power during these periods.

In the table import and export are accumulated net exchanges per hour. The net export for the month is 42% of the wind energy production.

The case demonstrates the unavoidable overflow of electricity during a Danish winter season. Whether the overflow is wind energy or CHP electricity is a matter of faith. It is also a matter of faith if the overflow is a problem or not.

An Increasing Gap between Export and Import Prices in 2013

The 400 MW Anholt offshore wind farm was commissioned in the autumn of 2013. Therefore the January 2014 figures cannot be compared with the 2013 average values.

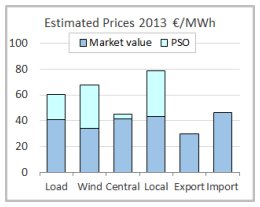

The average market values of consumption, production and exchange in 2013 have been estimated on the basis of the hourly spot prices for each of the two Danish price areas. The spot prices are considered to give realistic estimates though other prices have been used for parts of the trade.

The chart with exchange of electricity per month demonstrates the magnitude of the Danish balancing challenge. CHP and wind power have together created a considerable surplus in the winter and an even larger deficit in the summer. The reason for the deficit is that power plants are being mothballed or decommissioned due to insufficient business volume.

The Smart Grid intentions of moving some consumption a few hours from day to night will not be able to relieve the need for foreign balancing services significantly.

In any case, Denmark must purchase balancing services in the international electricity market. Therefore it is essential to observe the cost and to compare it with possible local measures.

The estimated average market value of the consumption was € 40.56 per MWh in 2013. With this value as reference the value of electricity from large CHP units was 101.4% and from Local CHP units 106.4%. The reason for a higher average for local units is that most operators of these units can concentrate their limited production to hours with high market prices.

The average value of export was 73.9% and of import 113.5%. The additional cost of import during the summer season seems to be affordable while the loss on export is notable.

It is impossible to calculate the cost of the foreign balancing services because it would take a detailed alternative with domestic resources for a partial replacement of import and export. This alternative does not exist.

Generally it is an advantage to share resources internationally in order to provide to best possible service to the consumers. However, it is also necessary to consider the strategic and commercial risk of being dependent on foreign resources. National security also has a cost.

Increasing International Competition for Balancing Services

The strategic and commercial risk of supply problems is usually given a decreasing priority during stable and peaceful periods. There are always good excuses for being insufficiently prepared for the unexpected international crises such as the oil crisis in the seventies and the recent concern for European gas supplies from Russia.

The Danish need for foreign balancing services will probably increase considerably in the years to come. A similar development is likely to take place in Germany and in other European countries. This will increase the competition among purchasers of balancing services.

The Danish government seems to be comfortable with the increasing dependence on foreign services. Therefore, it is important to observe the development in exchanges and prices and to encourage careful studies of local alternatives regarding commercial and strategic perspectives.

From the consumers point of view the also the support mechanisms for renewable energy must be considered. In Denmark PSO (Public Service Obligations) is one element of the support. Unfortunately, the PSO accounts for 2013 have not yet been published. For illustration, estimated values have been used for the chart.